Introduction

Thank you for purchasing an indicator or bundle from Kenzing®. This brief introduction contains instructions on how the indicator functions and how to adjust the input values that allow you to personalise the indicator according to your trading strategy. Information on how to access the indicator after purchase is not included in this document and can be found in the Read Me FAQ document.

Understanding the Indicator

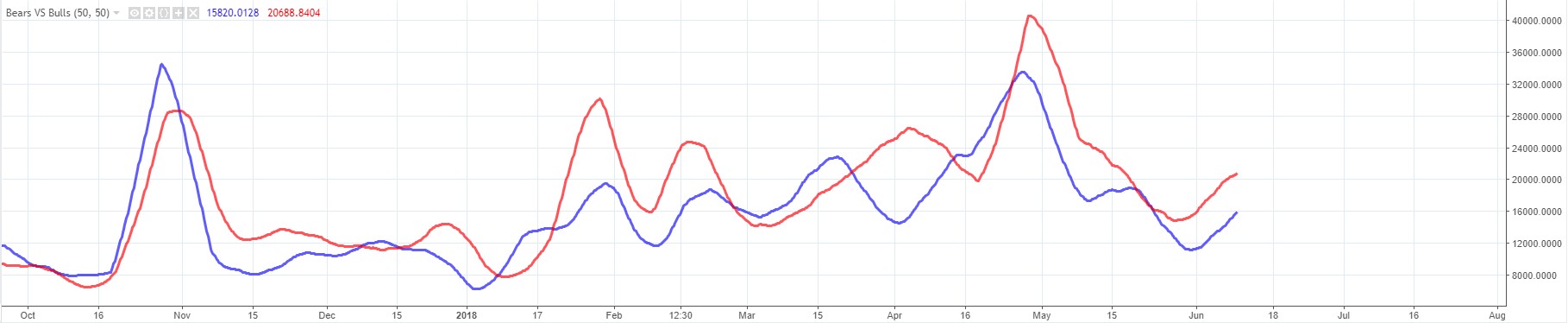

The Bears VS Bulls indicator is a customized, non-bounded, convergence-divergence technical indicator that contains two moving averages. However, unlike most moving averages associated with open-market technical analysis, the Bears VS Bulls indicator does not source any data from the price action of the underlying asset.

Instead, Bears VS Bulls analyses the volume – separating the long volume from the short volume, and benchmarking the two against each other as moving averages.

When the moving average of long volume is higher than the short volume, we know that bullish sentiment is stronger than the bearish. Inversely, when the moving average of short volume is higher than the long volume, we know that bearish sentiment is stronger than the bullish.